New Thousand Oaks The Habit Burger Grill Continues This Burger Chain's Success Story

/The Habit Burger Grill originated on November 15, 1969 at 5735 Hollister Ave, Goleta - a location that is still in operation to this day. The Habit is a fast casual restaurant concept that specializes in preparing fresh, made-to-order char-grilled burgers and sandwiches featuring USDA choice tri-tip steak, grilled chicken and sushi-grade albacore tuna cooked over an open flame.

The chain was purchased by a private equity firm in 2007 and subsequently The Habit Restaurants, Inc. went public with an initial stock offering on November 19, 2014, 45 years after its inception.

The new location coming soon to Thousand Oaks. Ever wonder why the "b" in Habit is slightly twisted? I asked. The Habit indicates it "makes it special and light hearted."

A new location is coming to Thousand Oaks at the former Famous Dave's BBQ location at 3980 Thousand Oaks Blvd. This will mark the 4th Conejo Valley Habit Burger location, including existing locations in Thousand Oaks, Newbury Park and Agoura Hills. Additional Ventura County locations in Simi Valley (2), Camarillo, Oxnard and Ventura (2).

The Habit trades under stock symbol HABT and currently is (as of December 20, 2016) at $17.30 per share, down 4% from its initial public offering price of $18 per share. That said, its price soared to close at nearly $40 per share that first day of trading, making it a bit of a terrible investment for those that bought after the IPO.

Stock price aside, The Habit has been quite a success story, growing to 160 restaurants in 10 states and opening new restaurants at the rate of over 30 per year. Total revenue for The Habit's fiscal year 2016 is anticipated to be in the $283 million range.

Photo courtesy of The Habit Burger. While my Habit Burger doesn't look quite this perfect, that's no big deal. It usually reaches my mouth before my eyes have much time to admire it.

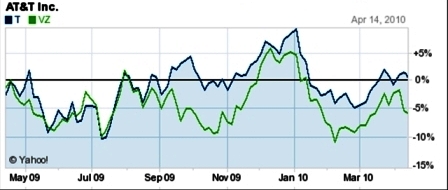

But back to stock price. For a growth stock like The Habit, timing can be critical. Let's look at an example. Over the last two years ending today, had you purchased $100 in McDonald's stock (MCD), the value of that investment today would be $131, and you would have received cash dividends of close to $8, for a total return of 39%. $100 invested in HABT would now be worth about $52.

So while The Habit Burger may have been rated #1 burger in a 2014 Consumer Reports survey (and I for thoroughly enjoy the burgers and other menu items at The Habit), you don't necessarily always want to put your money where you mouth is. Or your mouth where your money is, for that matter.

To learn more about The Habit, visit www.habitburger.com.