Ventura County 2-1-1 for Human Service Programs

/Ventura County 2-1-1 provides a quick, easy, free and confidential way to obtain information and local referrals for these types of services:

Basic human needs, such as food, shelter, clothing and other support

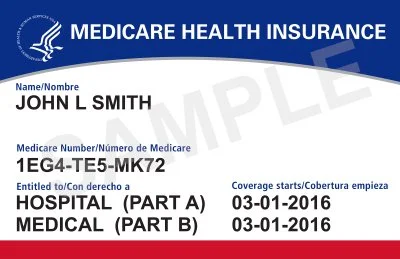

Physical and mental health resources, including intervention services, crisis counseling, support groups, counseling, drug and alcohol intervention and health insurance programs

Employment support, including unemployment assistance, job training, education assistance, transportation help, etc.

Support for elderly and disabled individuals, such as convalescent care, home health care, meal services and transportation services

Children, youth and family support, including childcare, after school programs, family resource centers, mentoring, recreation, tutoring, protective services, etc.

Volunteer opportunities and donations

Ventura County was the first county in California to launch 2-1-1 service on February 11, 2005. The Ventura County 2-1-1 service is staffed 24 hours a day and is managed by Interface Children & Family Services with the support of the Ventura County United Way and First 5 Ventura County. Additional support is received from the County of Ventura, the County of Ventura Health Care Agency, the County of Ventura Human Services Agency, and the cities of Camarillo, Ventura, Oxnard, Simi Valley, Port Hueneme, Moorpark, Ojai and Thousand Oaks.

For more information about 2-1-1, visit www.211ventura.org.