Should I Start Collecting Social Security Benefits Before Reaching Full Retirement Age?

/Full Retirement Age (FRA) was 65 for many years. Congress passed a law in 1983 to gradually increase FRA to reflect increasing lifespans. FRA currently ranges from 65 for those born before 1943 to 67 for those born in 1960 or later. At what point should you start taking Social Security payments?

You can also start receiving Social Security benefits as early as age 62, but your monthly benefit would be reduced anywhere from 25 to 30% as a result. See www.ssa.gov/benefits/retirement/planner/agereduction.html for more information on how much you would receive, based on your year of birth.

You can also delay receiving Social Security beyond your FRA, up until age 70. The benefit to doing this is that your benefits are increased anywhere between 5.5% to 8% per year. See www.ssa.gov/benefits/retirement/planner/delayret.html for more information.

What if you start taking Social Security at age 62 but are still working? Depending on your level of income, that could defeat the point of taking early Social Security. Why? Because before you reach FRA, the SSA withholds $1 of every $2 you earn in excess of $22,320 (in 2025) per year from your Social Security payments. Then the year you reach FRA, they still withhold $1 for every $3 in excess of $59,520 (in 2025) until the month you reach FRA. Effectively, if you’re still working at ages 62 to 67, it may defeat the point of taking early FRA.

Note that they do adjust you future payment for the amounts they withhold up until FRA, once you reach FRA. However, they are not paid immediately. They are stretched out over your actuarily determined lifetime via higher monthly payments.

Let’s look at a simple example:

Conejo Joe was born in 1960 and thus turned 62 in 2022. His FRA is 67. His full retirement benefit is, say, $1,000 per month. If he chooses to start receiving payments at age 62, they would be reduced by 30%, to $700 per month. If he chooses to delay receiving benefits until age 70, they would increase by 8% per year over 3 years, to $1240 per month (ignoring increases for inflation).

If Conejo Joe started receiving $700 per month at age 62, by the time he reaches age 70 he would have received $58,800 (ignoring inflation increases). If he waited until age 70, he would receive $1240 per month, or $540 per month more than starting benefits at age 62. It would take him about 9 years to make up the gap.

But if Conejo Joe had other income or continued working at age 62, up to 85% of those $700 per month Social Security payments could be taxed at the federal level (most states, including California, do not tax Social Security benefits). Those taxes should be factored into the decision as to whether he should delay receiving benefits.

If Conejo Joe started taking Social Security at age 67, he would receive $1,000 per month. So by the time he reaches age 70, he would have received total payments of $36,000 (again, ignoring inflation). Had he waited until age 70, he would receive $1240 per month, or $240 more than the FRA benefits he received for the last three years. It would take him 12 1/2 years to make up the $36,000 gap. So if he anticipates living until at least age 82 1/2, in theory it makes sense to wait until age 70 to collect benefits, if possible.

Everyone’s situation is different. Some folks really need the payments early. Others can wait because they are still working. Visit www.ssa.gov for more information and talk to your financial planner and/or CPA for guidance.

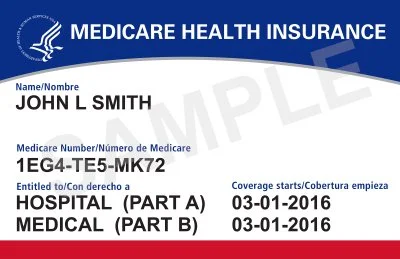

One final point. The Social Security Administration says “If you decide to delay your benefits until after age 65, you should still apply for Medicare benefits within three months of your 65th birthday. If you wait longer, your Medicare medical insurance (Part B) and prescription drug coverage (Part D) may cost you more money.