Income Planning to Keep Your Medicare Part B Premiums From Increasing

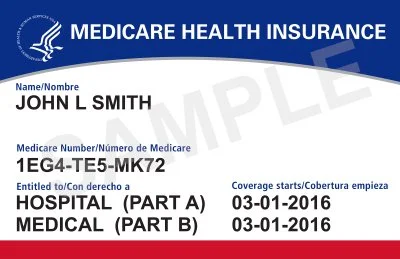

/Medicare Part B covers certain doctor services, outpatient care, medical supplies and preventive services. You pay a monthly premium for Part B that is automatically deducted from your Social Security benefit payment.

Most people will pay the standard premium amount. If your modified adjusted gross income (MAGI) is above a certain amount, you may be charged an Income Related Monthly Adjustment Amount (IRMAA) - basically a higher premium.

Your MAGI is your total Adjusted Gross Income plus tax-exempt interest income, non-taxable Social Security benefits and untaxed foreign income on your tax return.

Medicare uses the MAGI reported on your IRS tax return from 2 years ago to determine your current year premium.

For example, the standard Part B premium in 2023 is $164.90. If your MAGI on your 2021 return was $97,000 or less if single or $194,000 or less on a joint tax return, you pay the standard 2023 premium.

If the MAGI on your 2021 tax return was between $97,000 up to $123,000 (single taxpayers) or between $194,000 up to $246,000 on a joint return, your 2023 premium would be $230.80.

There are additional income ranges that can bring your monthly premium as high as $560.50 per month in 2023, if your MAGI in 2020 was $500,000 or more for single or $750,000 or more for joint taxpayers. Visit www.medicare.gov/your-medicare-costs/part-b-costs for more details.

These bunnies are too young for Medicare but are discussing future healthcare options nonetheless.

ARE YOU FILING AS MARRIED FILING SEPARATELY? BE CAREFUL!! If your individual MAGI is above $97,000 and less than $403,000, your monthly premium jumps from $164.90 to $527.50. That’s a huge jump.

TAX PLANNING: Let’s say you are single and have $45,000 in Social Security, $35,000 in IRA distributions and $15,000 in interest and dividends in 2021. That brings you to $95,000 in MAGI, which is below the $97,000 threshold where they increase your premiums. If you sold a stock for a $2,001 gain, that would bring you to $97,001 in MAGI and your monthly premium would jump by $66 per month. Perhaps it would be wise to wait and sell that stock in 2022.

The only problem is, Medicare doesn’t announce next year’s premium parameters until the fall, which usually is after you’ve filed your previous year tax returns. What to do?

Well here we are near the end of 2023, which will be used to establish 2025 Part B premiums. The best you can do is just use the 2021 parameters and plan accordingly.

The MAGI cut-off for standard premiums in recent years have changed as follows:

2021 (for 2023): $97,000 (single), $194,000 (joint)

2020 (for 2022): $91,000, $182,000

2019 (for 2021): $88,000, $176,000

2018 (for 2020): $87,000, $174,000

2015-2017 (for 2017-2019): $85,000, $170,000

What happens if your income jumps really high one year? You sell a rental property, win the Lotto, take a new job, etc. Well, your premiums will jump if your MAGI leaps over those income parameters. Not much you can do about it. The good news is that it will drop back down the following year if your MAGI drops below the income threshold.

There are some unique situations where you are allowed to an appeal a Part B premium IRMAA after you receive your notice from the Social Security Administration. Certain life-changing events that cause an income decrease can be considered to reduce your premium, such as death of a spouse, marriage, divorce, reduction in work hours, loss of pension, involuntary loss of income-producing property due to a disaster and receipt of settlement from employer due to closure or bankruptcy.

Visit www.medicare.gov for more information.